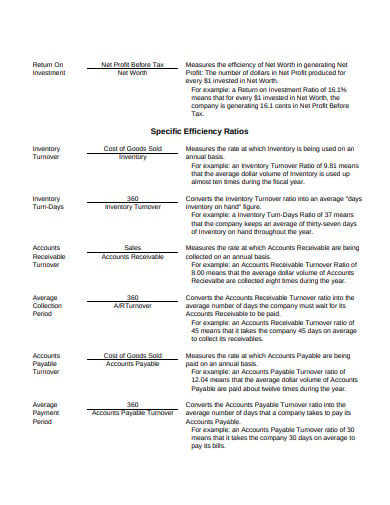

You have a conservative credit policy.It’s important to track your accounts receivable turnover ratio on a trend line to understand how your ratio changes over time. And if you apply for a small business loan, your lender may ask to see your accounts receivable turnover ratio to determine if you qualify. Additionally, when you know how quickly, on average, customers pay their debts, you can more accurately predict cash flow trends. Tracking this ratio can help you determine if you need to improve your credit policies or collection procedures. Your accounts receivable turnover ratio measures your company’s ability to issue credit to customers and collect funds on time. Why is it important to track accounts receivable turnover? Efficiency ratios can help business owners reduce the amount of time it takes their business to generate revenue. Other examples of efficiency ratios include the inventory turnover ratio and asset turnover ratio. Efficiency ratios measure a business’s ability to manage assets and liabilities in the short-term. The accounts receivable turnover ratio is a type of efficiency ratio. On the flip side, a lower turnover ratio may indicate an opportunity to collect outstanding receivables to improve your cash flow.

An accounts receivable turnover ratio of 12 means that your company collects receivables 12 times per year or every 30 days, on average.Ī higher accounts receivable turnover ratio indicates that your company collects funds from customers more often throughout the year. Your efficiency ratio is the average number of times that your company collects accounts receivable throughout the year. The accounts receivable turnover ratio, or debtor’s turnover ratio, measures how efficiently your company collects revenue. What is the accounts receivable turnover ratio?

0 kommentar(er)

0 kommentar(er)